Table of Contents

Management Summary

Cheap, plentiful, reliable renewable energy is essential for a sustainable, prosperous future for the whole world.

Renewable electricity for less than a tenth of a cent per kWh

The Tabbre Project is developing innovative oceanic photovoltaic technologies to produce renewable energy that is both cheaper and more abundant than fossil fuels. Tabbre’s floating solar farms will be located within tropical oceanic gyres that are remote international waters. These regions are largely sterile, deserted of both plant and animal life and far from any human activity such as shipping lanes.

This will transform the global energy market and help accelerate the economic development of the emerging world while providing global energy security.

Using crypto speculation to fund the vision

Central to this initiative are Tabbre’s two cryptocurrencies: TABB, a fixed-supply deflationary digital asset used for fund raising, governance, staking and collateral, and BRE, a stable value coin tied to Tabbre’s energy production and serving as the medium of exchange for the sale of energy.

By issuing and managing TABB, the Tabbre Project will significantly improve both its access to capital and its cost of capital by leveraging the speculative and highly liquid cryptocurrency markets.

A massive investment flywheel

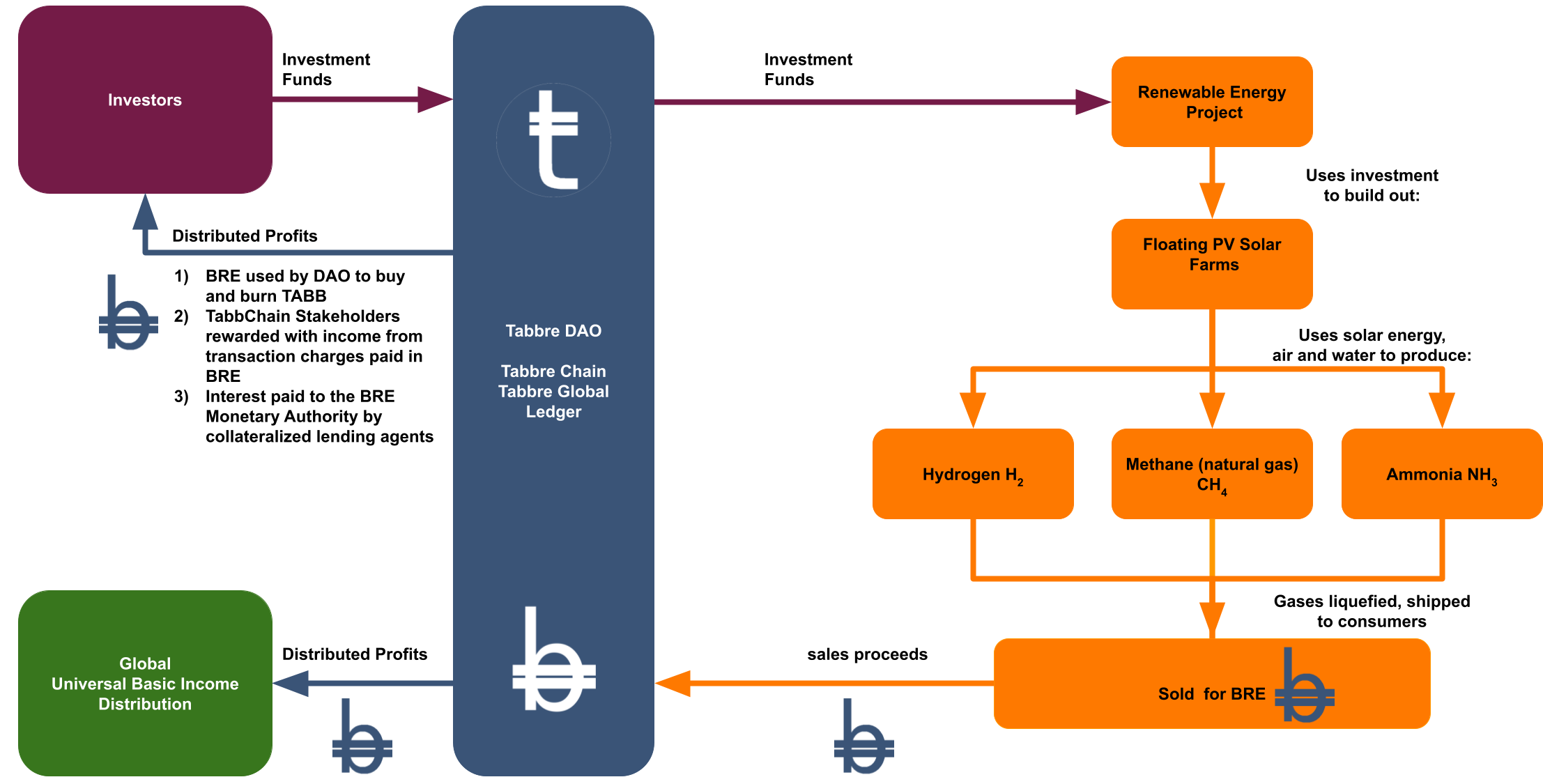

All profits will be reinvested into building Tabbre’s renewable energy production and distribution capacity until a target output is reached. At which point profits will be distributed to TABB holders and to fund Tabbre’s global universal basic income (GUBI). The GUBI will be distributed in BRE. The distribution to TABB holders will be used to buy and burn TABB.

The Tabbre Project’s decentralized governance and tokenomic strategies are designed to ensure long-term stability, scalability, and inclusivity.

Through its role in the sale of energy and as the currency for the payment of a GUBI, BRE will become a self sovereign, fiat equivalent global currency of similar stature to other global currencies such as the US dollar and Euro.

The unbridgeable moat: a global crypto currency backed by energy

Tabbre’s innovative cryptocurrency model provides the Tabbre Project with a unique competitive advantage that will help ensure Tabbre’s dominant position as a global energy provider.

Measured in 2024 US$ values, if Tabbre achieves 50% market share by 2050, Tabbre’s revenues and hence profits in 2050 will be 3% of global GDP, or US$ 6 trillion . On a price earnings ratio of 20 to 1 this would place the network value of TABB at US$ 120 trillion, or 60% of global GDP. The value of TABB would be $120,000 (in 2024 dollar terms), before adjusting for TABB shrinkage. TABB would represent 12% of all global financial assets.

This document provides a comprehensive overview of the mechanisms and strategies that position the Tabbre Project as a leader in the transition to a sustainable and equitable energy future.

Introduction

The purpose of this document is to describe the tokenomics of the Tabbre Project, an initiative designed to revolutionize the global energy and financial sectors. Through the integration of innovative floating solar technologies and a dual cryptocurrency model, the Tabbre Project aims to provide abundant, affordable renewable energy while fostering a decentralized global financial system.

The scope of this document encompasses the foundational concepts, mechanisms, and operational strategies underpinning the Tabbre System. It explores the roles and dynamics of the two principal tokens, TABB and BRE, and their integration into a broader framework aimed at addressing the global challenges of climate change, energy insecurity, and world poverty.

The intended audience for this document includes stakeholders, investors, developers, policymakers, and anyone interested in the Tabbre Project's potential to create a sustainable and equitable energy and economic future.

Overview of the Tabbre Project

Cheap, plentiful, reliable renewable energy is essential for a sustainable, prosperous future. The Tabbre Project's floating solar farm technologies, coupled with Tabbre’s unique tokenomic model, will provide the world with cheap and abundant renewable energy.

The Problem

Net Zero policies are making access to energy unreliable and expensive. This is a disaster for the world's poor. This is because today's renewable energy is very expensive when compared to coal, oil and gas.

The reason that renewable energy is expensive is the enormous and hence very expensive scale of infrastructure that is needed to capture enough sunlight and wind energy to cope with intermittency and seasonality.

As a consequence of the cost and unreliability of renewables, the transition from fossil fuels is not expected to happen. The following graph shows this.

Source: U.S. Energy Information Administration [^1]

On current trends, by 2050, annual global hydrocarbon consumption will be 600 Quintillion BTU, equivalent to 6.33×10²⁰J. This is 20 Terrawatts [^2].

Renewable energy adoption will have slowed the growth consumption of fossil fuels but not eliminated them. This represents a considerable failure of net zero policy.

The Solution

The only viable way to achieve net zero is to make renewable energy cheaper and more abundant than fossil fuels. Tabbre will achieve this by creating vast oceanic photovoltaic solar farms. These will use flexible lightweight floating structures made from recyclable plastic. They will be located in the oceanic gyres of the South Atlantic, South Pacific and South Indian Ocean.

These oceanic gyres are deserted, largely sterile, tropical international waters covering tens of millions of square kilometres.The electricity generated will be used to electrolyse water into hydrogen and oxygen. Hydrogen can be converted to methane or ammonia.

The hydrogen, methane and ammonia gases will be compressed or liquefied for shipping to consumers as a clean chemical fuel replacement for fossil fuels such as coal, natural gas and oil. Using solar energy to produce hydrogen, methane and ammonia solves the problem of intermittency since these fuels, unlike electricity, can be easily transported and stored for later consumption.

The Tabbre Project aims to have a marginal cost of energy production close to zero, this is based on AI facilitated automation replacing labour, recycling replacing the need for new raw materials and the fact that the open ocean is free to use.

Tabbre's sustainable energy will be much cheaper and more plentiful than fossil fuels, and so market forces will drive the transition from fossil fuels to sustainable energy.

The role of TABB and BRE

|  |

|---|---|

| TABB: Token for the Administration of the BRE Blockchain | BRE: Basic Renewable Energy |

To make this vision possible, Tabbre is creating two new cryptocurrency assets: TABB and BRE. These will be expressed on a new blockchain, the TabbreChain. The TabbreChain uses a proof of stake consensus. The technical details of the TabbreChain are explored in the TabbreChain White Paper.

Transaction charges and other usage fees are payable in BRE. TABB is used as collateral for the stakes used in the TabbreChain's proof of stake consensus protocol. Stakeholders are rewarded in BRE.

The TabbreChain will provide a smart contract execution environment. The TabbreChain hosts the smart contracts that encode the decentralized foundation's governance and tokenocracy rules. The governance smart contracts are amendable using a tokenocracy, whereby holders of TABB will be able to vote to either allow or disallow amendments. This allows the Tabbre system to grow and evolve over time to reflect society's changing needs.

TABB is like Bitcoin in that it has a fixed maximum supply.

A large fraction of all TABB will be held by a decentralized foundation, The Tabbre Foundation. The Foundation's TABB holdings will be used as collateral for debt finance to fund the development of Tabbre's oceanic floating solar farms.

BRE will be issued and managed by the The Tabbre Foundation using an algorithmic method to ensure the value of BRE remains stable relative to a basket of commodities and global fiat currencies.

The renewable energy generated by Tabbre will be priced and sold for BRE. BRE will be backed by the value of energy generated by the Tabbre scheme.

The Tabbre Foundation

The Tabbre Foundation is central to the governance of the Tabbre System. It will be constituted as a Decentralized Autonomous Organization, a DAO. As a DAO the Foundation will have a democratic constitution with the rules governing this being encoded into smart contracts hosted on the Tabbre blockchain.

Decisions regarding the purpose, direction and operation of the Tabbre Foundation will be made using a democratic system. The rules for this are described in the Tabbre Foundation Paper.

Distribution

As Tabbre develops, all profits generated by the scheme will be reinvested into more renewable energy capacity until a target energy output is reached. At this point, called the Distribution Point, profits will be distributed. The Tabbre decentralized foundation will distribute profits to TABB holders by using the profits to buy and burn TABB. The intent is to cause significant appreciation in the value of TABB.

BRE is created dynamically on the Tabbre blockchain, in accordance with the Tabbre system's governance rules.

Tabbre is expected to be hugely profitable when it achieves its objective of being the principal global supplier of energy. This diagram illustrates this.

The Global UBI

Tabbre's solar farms are located in international waters that are considered global commons.

In the interests of social fairness and social cohesion and as a protection against confiscation by governments, Tabbre intends to use a significant fraction of profits from the scheme to fund a global universal basic income (UBI). This will be distributed in BRE.

BRE's role in paying the global UBI coupled with BRE's role as the currency for trading energy will allow BRE to become a non national self-sovereign decentralized global reserve currency.

The Tabbre Project will help transition the world from fossil fuels and establish a global decentralized financial system and in so doing will help end both the climate crisis and global poverty.

Global Decentralized Financial System

BRE is both the currency for the pricing and sale of energy generated by the Tabbre scheme and the currency for distributing Tabbre's global UBI.This will create a substantial and sustainable global economic role for BRE allowing it to become an international decentralized currency to rival fiat currencies. As such BRE will need to be created in sufficient quantities that it operates as a stable value coin. It is envisaged the value of BRE will be governed by the average price of energy produced by the scheme. Tabbre's dual coin scheme will be a censor resistant global monetary system that will supplement and compete with the world's existing fiat based banking systems.

TABBRE Tokenomics

The Design of the Tokenomic Model

The Tabbre Tokenomic model is designed to ensure that BRE can operate as a fiat equivalent currency and that TABB will be an excellent and fast appreciating asset that can be traded by the Tabbre Project to fund its initial capital expenditure. The economic models for both BRE and TABB are based on scarcity in the face of significant demand.

BRE Economics

The economic model for BRE is inspired by the economic model that underpins established fiat currencies. Currencies are fungible commodities that can be exchanged for goods and services. The value of fiat currencies derives from a supply and demand ratio: the greater the demand for the currency the more valuable it becomes relative to other goods and services in the economy.

The demand for fiat currency that under pins its value is created by a number of factors:

Tax: all countries require that taxes be paid in their own fiat currency. Since tax accounts for between 30% and 50% of most developed economies, this creates a significant demand for fiat

Credit: all fiat currency is created by the banking system as credit. This means that there is always a demand for fiat currency because the credit needs to be repaid.

Interest payments: because all fiat is created as credit, for which interest is charged, it means that there is always more money owing than money in existence, which creates a demand for money. This relative scarcity helps maintain the value of money relative to all other goods and services in the economy.

BRE will have a fiat equivalent economic model to ensure BRE price stability, or in other words: BRE will be as good as a well managed fiat currency for retaining its value. BRE’s economic model is underpinned by:

ALL energy produced by the Tabbre Project will be sold for BRE. This will drive the demand for BRE in the same way that countries require their fiat currency to be used to pay taxes.

Credit: All BRE will be created as credit. The BRE monetary authority will create and then lend BRE to Collateralized Credit Agents, described in this document, This means that there is always a demand for BRE currency because the credit needs to be repaid.

Interest payments: because all BRE is created as credit, for which interest is charged, it means that there is always more BRE owing than BRE in existence, which creates a demand for BRE. This relative scarcity helps maintain the value of BRE relative to all other goods and services in the economy.

TABB Economics

As noted, the economic model behind TABB is based on scarcity in the face of significant demand.

This is achieved in the following way.The supply of TABB is fixed with a single token creation event at which point all TABB will be created. Over time this supply will shrink for the following reasons:

Wastage: Accounts containing TABB becoming permanently dormant, for example through loss of access to private keys or the death or incapity of account owners.

Repurchase: The Tabbre Project will distribute profits by buying and burning TABB, this will lead to a permanent shrinkage of the quantity of TABB

Slashing: TABB will be used as the collateral for the TabbreChain proof of stake consensus. TABB slashed as a result of a node misbehaving will be burnt.

Foreclosure: If a collateralized credit agent fails to repay the BRE Monetary Authority, the BRE monetary authority will retain the TABB posted as collateral and may burn this TABB. This will increase the relative value of the remaining TABB.

This shrinking supply of TABB stands in contrast to the ever increasing demand for TABB, driven by the following factors:

Buy backs: Profits will be distributed to TABB holders by buying and burning TABB

TABB holders will be able to deploy TABB to earn a return paid in BRE. This will create a demand for TABB as it will be an income earning asset.

Collateralized Credit: Providing TABB for use as collateral for

Staking: Participating in the TabbreChain Proof of Stake consensus will be rewarded with a share of the TabbreChains transaction charge income

Tokenocracy: Participation in the decision making process of the Tabbre Foundation DAO will be based on a tokenocracy with one TABB one vote. This may result in demand for TABB as parties interested in influencing the Tabbre Foundation’s policy try to acquire TABB.

This model ensures that TABB will become extremely valuable even if the Tabbre Project only achieves modest success and if the Tabbre Project achieves its target of becoming the world’s dominant energy supplier the network value of TABB will be measured as a large fraction of global financial assets. At the time of writing this, Bitcoin’s network value is over $2 trillion. And that is despite the fact that BTC serves no economically valuable social purpose.

The Tabbre Project aims to have a marginal cost of energy production close to zero, this is based on AI facilitated automation replacing labour, recycling replacing the need for new raw materials and the fact that the open ocean is free to use. So that all sales revenue from energy will be profit.

To give some idea as to the scale of this: In 2024 fossil fuel sales amounted to US$ 6 trillion which is about 6% of global GDP which was estimated at being c. US$ 100 trillion. The total value of financial assets is estimated to be 5x global GDP or just over US$ 500 trillion. The world bank expects global GDP to double in real terms by 2050, to US$ 200 trillion and the value of energy sales and global financial assets will also double in this time to US$ 12 trillion and US$ 1000 trillion respectively.

Measured in 2024 US$ values, if Tabbre achieves 50% market share by 2050, Tabbre’s revenues and hence profits in 2050 will be 3% of global GDP, or US$ 6 trillion . On a price earnings ratio of 20 to 1 this would place the network value of TABB at US$ 120 trillion, or 60% of global GDP. The value of TABB would be $120,000 (in 2024 dollar terms), before adjusting for TABB shrinkage. TABB would represent 12% of all global financial assets.

The TabbreChain

The Tabbre Project is a decentralized scheme whose existence is made possible by the capabilities provided by blockchain technology. As already noted, the Tabbre scheme utilizes two tokens: TABB and BRE. The TabbreChain that expresses the TABB and BRE coins is a proof of stake blockchain. The key components of TabbreChain’s proof of stake:

Validators: Network participants who stake their cryptocurrency to validate transactions and create new blocks

Staking: The process of locking up a certain amount of cryptocurrency as collateral to become a validator.

Selection Algorithm: A method for choosing which validator gets to create the next block, this is based principally on the amount of TABB staked

TabbreChain’s proof of stake works in the following manner:

Validator Selection: Validators are chosen to create new blocks based on the amount of TABB they have staked and other factors like how long they've held their stake

Block Creation: The selected validator verifies transactions, creates a new block, and adds it to the blockchain

Validation: Other validators in the network check the proposed block for accuracy

Consensus: If the majority of validators agree that the block is valid, it's added to the blockchain

Rewards: The validator who created the block receives a reward, in the form of collected transaction fees paid in BRE.

Penalties: Validators who act maliciously or make mistakes can lose part or all of their stake, incentivizing honest behavior.

The economic case for staking is that staked TABB will be at risk but will earn a return in the form of block rewards (both BRE transaction fees and newly minted TABB).

Block rewards and transaction fees are paid in BRE.

The Tabbre Project’s objective is to become the principal global supplier of energy and as such the Tabbre scheme is expected to be hugely profitable. All profits generated by the scheme will be reinvested into more renewable energy capacity until a target energy output is reached. At this point, called the distribution point, profits will be distributed. The Tabbre Foundation will distribute profits to TABB holders by using the profits to buy and burn TABB. The intent is to cause significant appreciation in the value of TABB.

TABB Allocation

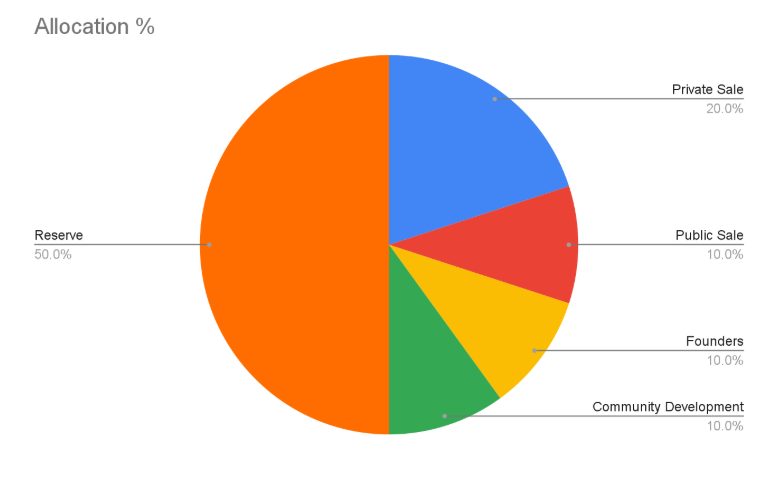

TABB is a digital gold cryptocurrency and as such has a limited issuance, a total of 1,000,000,000 TABB will be created. The allocation of these TABB coins is set out in the following table:

| Purpose | Allocation % | Allocation Quantity |

|---|---|---|

| Private Sale | 20% | 200,000,000 |

| Public Sale | 10% | 100,000,000 |

| Founders | 10% | 100,000,000 |

| Community Development | 10% | 100,000,000 |

| Reserve | 50% | 500,000,000 |

| Total | 100% | 1,000,000,000 |

Private Sale

The TABB private sale aims to raise US$100 million by selling 200 million TABB tokens. The tokens will be sold at incrementally increasing prices through 1,000 tranches with a starting price of US$ 0.001 rising to an end of sale price of US$ 1.00 per TABB.

Public Sale

Following the end of the private sale, TABB will be offered to the general public with a starting price of US$ 2.00 per TABB. This will coincide with the listing of TABB on third party exchanges.

Founders

Up to 10% of TABB will be reserved for rewarding the founders. All TABB allocated to founders will be vested.

Community Development

The development and nurturing of a community is essential for the successful establishment of the Tabbre Project. Funds will be made available for influencers, developers and partners.

Reserve

The TABB reserve will be held in a vesting contract with 0.5% being released every month for 120 months. Reserve TABB that has been released from escrow will be deployed in one of the following ways:

Held as collateral for the issuance of bonds to raise funds for the Tabbre Project

Sold to provide liquidity to the market and to raise funds for use by the Tabbre Project.

Used as collateral for the issuance of BRE or as collateral for running TabbreChain proof of stake nodes

Distributed as payment for services provided by partners to the Tabbre Project

Held in reserve for future use

Burnt to reduce the potential supply of TABB

TABB Uses

As an appreciating asset, the Foundation will use its holdings of TABB as collateral for the sale of fiat denominated bonds. The funds raised from bond sales will be invested in commercially viable schemes that deliver sustainable energy generation, storage and distribution as well as other sustainable technologies. The profits generated from these investments will be reinvested in further commercially viable schemes that deliver sustainable energy generation, storage and distribution.

At some point in the future the Foundation will stop reinvesting profits and instead use its profits to purchase TABB from the open market.

The Foundation will burn any TABB that it purchases from the open market as well as burning the same amount of TABB from its reserves. Burning TABB in this way will reduce the supply of TABB and so should lead to an increase in the value of the remaining TABB.

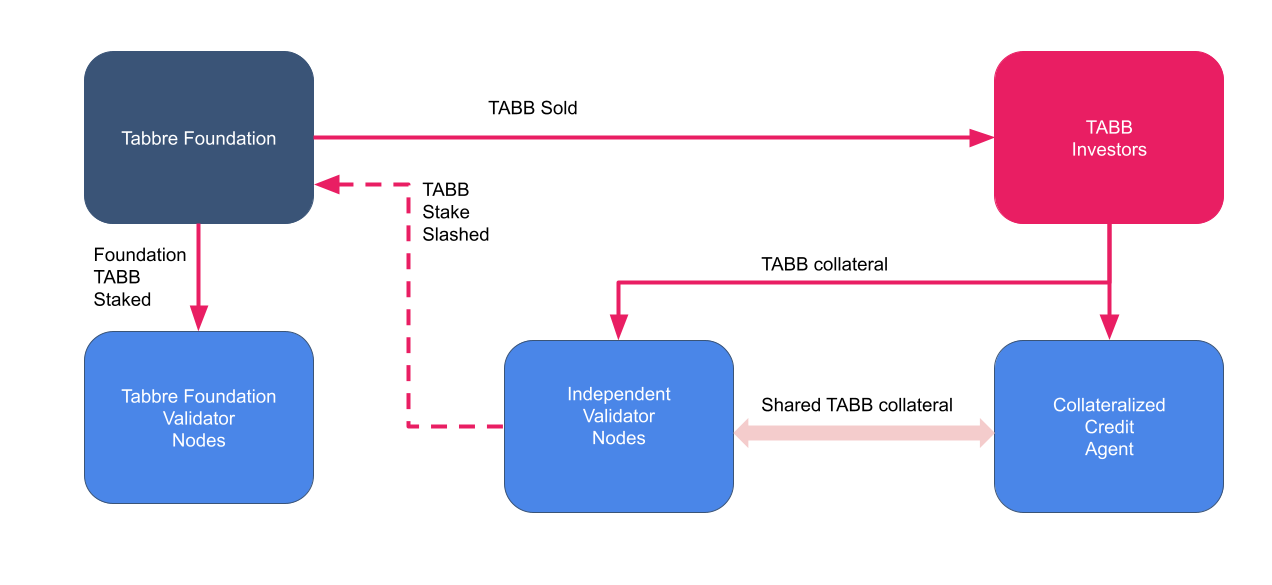

TABB Staking

The TabbreChain will initially be operated as a permissioned blockchain, however once the TabbreChain has reached a level of development stability it will be operated using a proof of stake (PoS) protocol. The asset used for staking will be TABB. Transaction fees will be payable in BRE.

The TabbreChain PoS consensus will be operated by a consortium. Consortium members will be eligible to operate a validator node on the TabbreChain blockchain. This will require the member to provide a minimum amount of TABB to be held by the scheme as a stake. This stake will be subject to slashing if the validator node transgresses e.g. by accepting and processing invalid transactions.

Transaction charges will be applied to transactions submitted to the TabbreChain. These transaction charges will be denominated and payable in the BRE. BRE will be the TabbreChain’s native transactional currency.

A detailed description of the organization and operation of the TabbreChain is provided elsewhere.

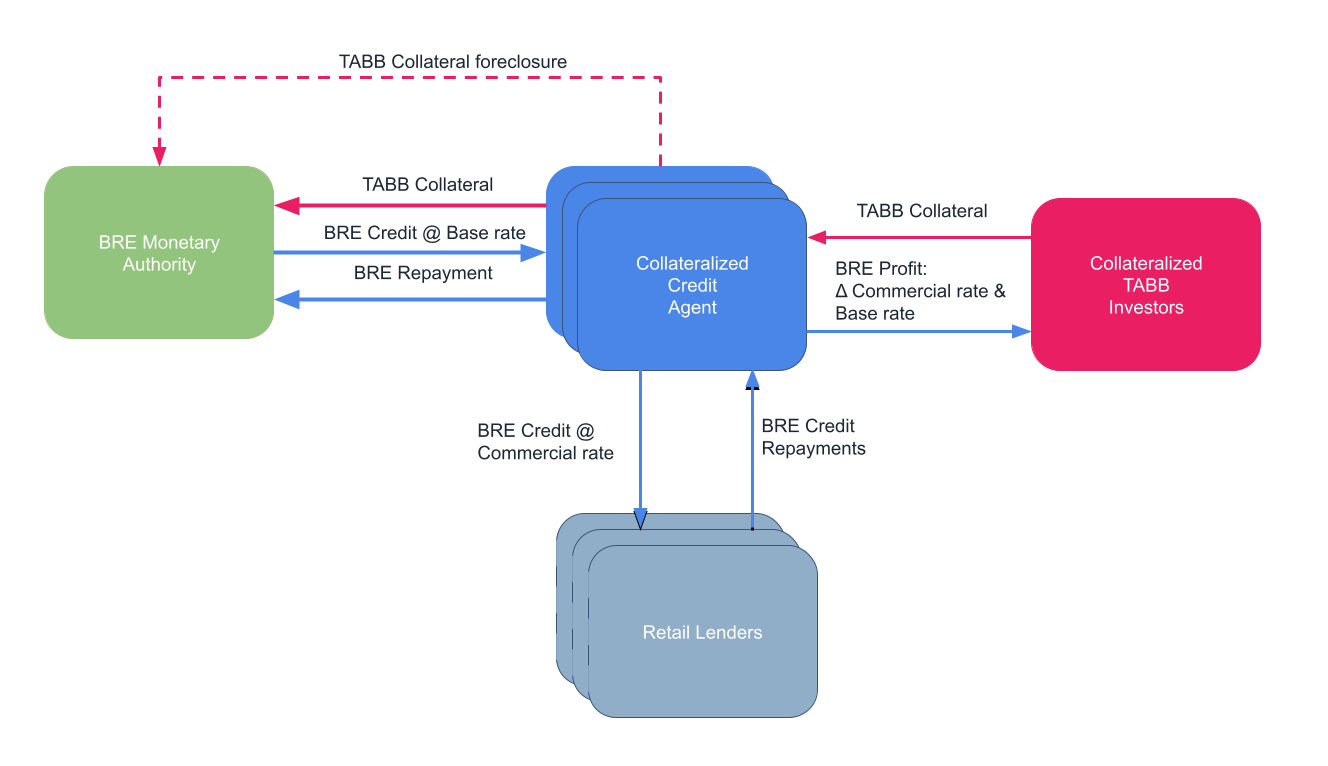

TABB Collateral

Once the Tabbre Scheme has reached production, BRE will be issued as credit by the BRE Monetary Authority (BMA). This credit will have a low interest rate associated with it. Collateralized Credit Agents (CCA) will use TABB as collateral for borrowing BRE from the BMA. The CCAs will lend the BRE that they borrow from the BMA at a low rate of interest to retail borrowers, who will pay a higher interest rate. Thus making the lending profitable for the CCAs.

The BMA will be charged with maintaining BRE price stability and will be able to use the credit creation process as a tool to achieve this aim.

TABB Buy back

Once the Tabbre Scheme has reached a target level of energy output, the Tabbre Foundation will use profits from the sale of energy to buy and burn TABB.

BRE Tokenomics

The principal role of BRE in the Tabbre system is as the currency for the sale of the sustainable renewable energy generated by the Tabbre Foundation’s portfolio of energy projects. Energy produced by the Tabbre Scheme will be priced in BRE and sold to customers in exchange for BRE. These customers will therefore need to have BRE to buy energy. This will create a demand for BRE and hence value for BRE.

BRE will also be used to pay Tabbre’s global universal basic income.

BRE Credit Creation

BRE will be a stable value coin in that its value will be linked to the value of a basket of global currencies and commodities and will be managed to achieve a degree of BRE price stability.

Initially, BRE will be created and held by the Tabbre scheme operator for paying suppliers and employees of the Tabbre Project. However, as Tabbre matures the issuance of BRE will be based on the credit creation process described here.

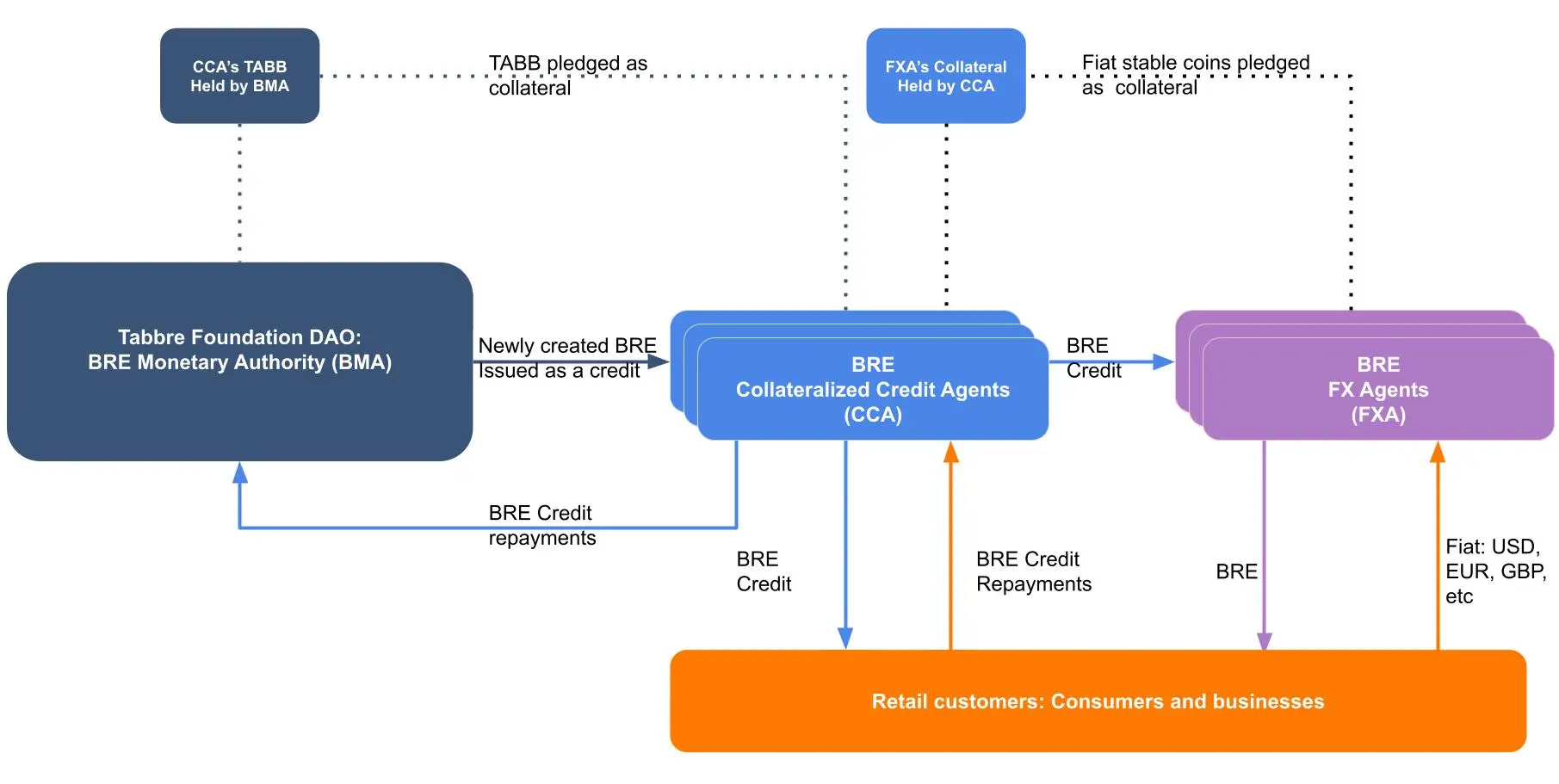

The BRE Monetary Authority (BMA) will be established. The BMA will be responsible for managing the BRE monetary supply, acting in a role analogous to that of a central bank in the fiat currency system. The BMA will be constituted as a DAO governed by the holders of TABB via a tokenocracy: One TABB one vote.

The BMA will be a decentralized autonomous organization. BRE will be created by the BRE Monetary Authority. New BRE coins will be minted onto the TabbreChain by the BMA. The BMA will manage the supply of BRE using an algorithmic process informed by data provided by oracle services.

In the early stages of the Tabbre Project, it is expected that BRE will be deflationary to support investment inflows. However as the Tabbre Project starts to sell energy priced in BRE, the management of the supply of BRE will be changed to deliver BRE price stability so that BRE becomes a usable means of exchange rather than a deflationary investment asset.

Creating all BRE as credit helps create a shortage of BRE, because there will always be more BRE owing than BRE in existence. This helps underpin the value of BRE.

The BMA will issue BRE denominated loans to intermediaries called Collateralized Credit Agents (CCAs).

The role of Collateralized Credit Agents will be similar to that of retail banks in the fiat money system in that they will provide retail lending services to consumers and businesses. However it should be noted that unlike the fiat system, where new money is created by retail banks, and bank deposits are owned by the banks and not the account holder, the only party who can create new BRE is the Tabbre Foundation and all BRE will be held on chain in wallets controlled by the owners of that BRE.

By using the centralized credit creation model the BRE Monetary Authority will be able to set interest rates and control the money supply to maintain the target value of BRE.

The CCAs will be required to pledge TABB as collateral for the BRE that they receive. This will help ensure that the CCAs lend responsibly. This will also act to reduce TABB liquidity helping to underpin the value of TABB.

In the event of a CCA not repaying a BRE loan to the BMA, or failing to comply with the loan agreement in some other way, the BMA will take the TABB collateral as full and final payment of the loan. Depending on the circumstances,TABB acquired in this way will either be vested, auctioned off or burnt. Whichever is most appropriate for ensuring stability of the TABB/BRE financial system.

The rate of interest charged by the BMA will act as the BRE economies base rate of interest, the BRE Base Rate (BBR).

The CCA’s will lend their borrowed BRE to retail customers including, inter alia: businesses, NGOs, consumers, state owned entities and local authorities. The interest rate charged by CCAs on their lending to the retail customers will be higher than the BBR. This provides the income for the CCAs. This could be considerable.

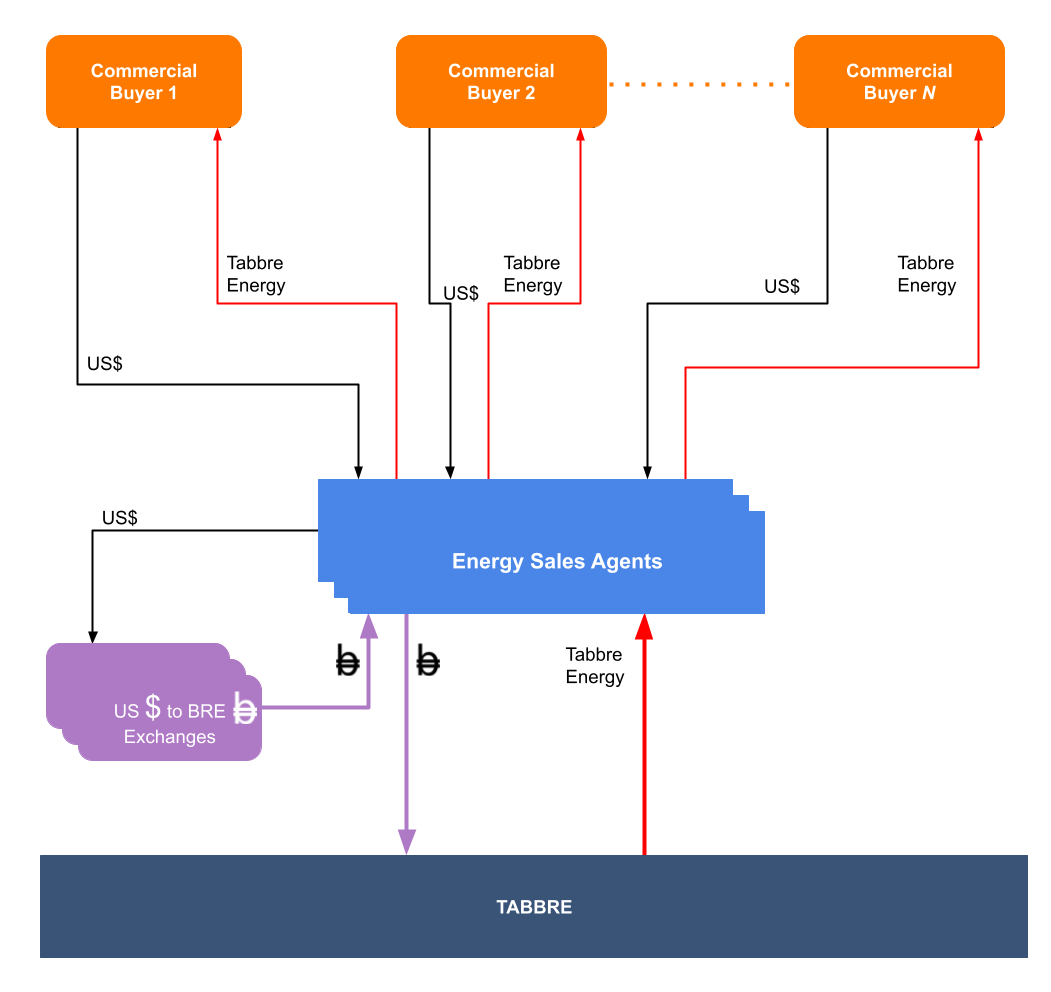

BRE and Energy

Tabbre intends to sell the energy that it produces for BRE. In the early stages of the Tabbre scheme, this may be problematic for the commercial entities that will be buying the energy. They may have an aversion, either because of regulation or cultural inertia to use BRE on the basis that it is not a fiat currency. To overcome this problem the Tabbre scheme will create intermediaries, Energy Sales Agents (Agents). These Agents will sell energy priced in fiat currency such as USD, EUR and GBP and will use the fiat currency proceeds from the sales to buy BRE in the open market. This will create a demand for BRE so ensuring that it has true economic value even before BRE is widely accepted as a legitimate currency.

Because the Tabbre Project will only sell its energy for BRE, BRE will become a currency whose value is underpinned by production and sale of energy, in other words, BRE will be backed by energy.

Distribution of profits

After the Distribution Point is reached, the scheme’s profits will be used to buy TABB in the open market. TABB bought in this way will be burnt thus creating a demand for TABB while reducing the supply of TABB.

The Tabbre DAO will be given the responsibility for the allocation of the scheme’s profits. It is envisaged that profits will be allocated to the following categories:

Research and Development

New Investment

Investor Returns

Global UBI

The Tabbre Treasury will be responsible for the distribution of profits. The Tabbre Treasury will be directed by the Tabbre DAO. The exact nature and modus operandi of the DAO is a subject of research.

Global Universal Basic Income (GUBI)

The Tabbre Project’s objective is to become the principal global supplier of energy. As such, once the Tabbre Project has matured it is expected to be hugely profitable. BRE’s role in paying the global UBI coupled with BRE’s role as the currency for trading energy will allow BRE to become a non-national self-sovereign decentralized global reserve currency.

Tabbre’s UBI will be paid by distributing a large fraction of the profits generated by Tabbre’s sales of energy. This will be economically very significant.

One of the challenges faced by the Tabbre Scheme is to ensure that it is not undercut by competition from fossil fuels. The distribution of Tabbre’s UBI has a role to play in this.

Tabbre can choose to withhold the UBI payments from the citizens of countries that consume fossil fuels. This will provide a significant incentive for governments to switch from fossil fuels to Tabbre’s carbon neutral synthetic hydrocarbon fuels.

The design and implementation details of Tabbre’s GUBI are outside of the scope of this document.

Global Decentralized Finance

This section sets out the benefits of Tabbre’s decentralized global financial system.

The US dollar’s global role

At the moment the U.S. dollar plays a pivotal role in the global economy as the dominant international currency. Its influence extends across trade, finance, and monetary policy. The dollar's global role brings significant benefits and challenges for both the United States and the rest of the world.

The U.S. dollar is the world’s primary reserve currency, comprising about 59% of global foreign exchange reserves, far surpassing other currencies like the euro that accounts for 20%. Central banks hold dollar-denominated assets, such as U.S. Treasury securities, to stabilize their own currencies and manage economic shocks.

The dollar is used in 54% of global trade invoices and dominates international payments, accounting for 58% of transactions outside the eurozone. It is also the main invoicing currency for trade between countries not involving the U.S., reflecting its widespread acceptance.

The dollar is central to global finance, with 64% of world debt denominated in dollars. It is also involved in nearly 90% of foreign exchange transactions. U.S. capital markets are highly liquid and accessible, attracting foreign investors to dollar-denominated assets.

Dollar assets are considered safe havens during periods of market stress due to their stability and liquidity. The Federal Reserve supports global financial stability by providing dollar liquidity through swap lines with foreign central banks during crises.

The challenges

The dominance of the US Dollar undoubtedly brings big benefits to the global economy and also the US economy, including lower borrowing costs for the U.S. government, businesses, and households due to high demand for dollar assets.

However there are a number of serious and growing challenges and risks associated with the dominance of the US dollar. These risks are primarily associated with the fact that the dollar is also the currency of a country: the United States of America. Dollar monetary policy including interest rates are quite rightly managed for the benefits of the United States own domestic economy and not the wider world.

In the recent past this has had serious consequences for the world. For example both the Latin American debt crisis that began in the early 1980s and lasted throughout the decade and the Southeast Asian financial crisis, also known as the Asian financial crisis, that started in July 1997 were both caused by increases in domestic US interest rates. The great financial crisis of 2008, was also caused by US domestic policy.

The US dollar’s status as the global reserve currency also leads to excessive dollar strength.

In the short term this may appear beneficial, but excess dollar strength has resulted in the de-industrialization of the United States, as domestic US based manufacturing is undercut by foreign producers. This is not a sustainable situation.

The BRE alternative

The Tabbre Project’s creation of a self sovereign global currency, in the form of BRE, will provide a credible alternative to the US dollar.

BRE will offer the following benefits:

Reduced geopolitical influence: It would eliminate the "exorbitant privilege" currently enjoyed by the United States, which allows it to pursue diplomatic or military initiatives more freely due to its currency's dominance.

Increased stability: A non-national currency will be less susceptible to the economic and political decisions of a single country, potentially providing more stability in the global financial system.

Fair representation: A global reserve currency could better represent the interests of multiple nations, rather than primarily serving the issuing country's interests.

Reduced economic imbalances: It will help address global economic imbalances that arise from the current dollar-centric system, where countries accumulate large dollar reserves for security.

Enhanced financial innovation: A new global reserve currency could incorporate modern technologies, such as blockchain, potentially leading to more efficient and transparent international transactions.

Diversification of risk: A non-national currency would distribute the risks and responsibilities of maintaining a global reserve currency across multiple stakeholders, rather than concentrating them in one nation.

Potential for greater economic equality: It will provide more equitable access to global financial markets for developing nations, potentially reducing economic disparities.

Reduced currency manipulation: A non-national currency will be less susceptible to manipulation for national economic gain, promoting fairer international trade.

Improved global economic governance: The management of a global reserve currency will involve international cooperation, leading to more balanced global economic policies.

Mitigation of the "Triffin dilemma": A non-national currency will help resolve the conflict between national monetary policy and global economic needs, which is inherent in the current dollar-based system.

Furthermore, the Tabbre System is decentralized. Decentralized finance (DeFi) offers several benefits for a global financial system:

Increased accessibility: DeFi allows greater access to financial services for individuals and businesses that may have been excluded from traditional financial systems, particularly in developing countries or for those without access to traditional banking services.

Enhanced transparency and security: DeFi transactions are recorded on public blockchains, increasing transparency and reducing the risk of fraud and corruption. The immutability of blockchain technology also enhances security and auditability.

Lower costs and higher efficiency: DeFi transactions are typically faster, cheaper, and more efficient than traditional financial transactions, as they eliminate intermediaries and automate processes through smart contracts.

Financial innovation: DeFi has led to the development of new financial products and services, such as decentralized exchanges (DEXs), yield farming, and new financial derivatives.

Greater financial freedom: DeFi enables individuals to take control of their own assets and manage their financial affairs without relying on centralized institutions

Global accessibility: DeFi platforms operate 24/7 and are accessible to anyone with an internet connection, removing geographical and socioeconomic barriers.

Interoperability: DeFi protocols and applications are built to integrate and complement one another, allowing for greater flexibility and innovation in the financial ecosystem.

Potential for financial inclusion: DeFi has the potential to provide financial services to the estimated 1.7 billion adults globally who do not have access to a bank account, potentially contributing to global economic equality.

Reduced remittance costs: DeFi services have the potential to significantly reduce the costs of cross-border remittances, benefiting foreign workers and their families.

Programmability: Smart contracts enable the creation of highly customizable financial instruments and automated execution of complex financial transactions.

Conclusion

The Tabbre System represents a transformative vision for addressing the challenges of climate change, energy scarcity, and global poverty. By using innovative oceanic floating solar farm technologies and a dual cryptocurrency framework, the Tabbre Project can redefine how renewable energy is produced, distributed, and financed on a global scale.

At the heart of this initiative are TABB and BRE, two complementary tokens. TABB serves as a secure and appreciating digital asset, while BRE functions as a stable value currency backed by the energy generated by the Tabbre Project. Together, they create a robust financial ecosystem that enables Tabbre to create a new global source of cheap and plentiful renewable energy, that will facilitate global economic development and underpins a global universal basic income (GUBI).

The project’s commitment to reinvesting profits into expanding renewable energy capacity ensures its long-term sustainability and competitiveness. Additionally, the decentralized governance model, through the Tabbre DAO, provides a dynamic and adaptable framework that aligns with evolving societal and environmental needs.

By integrating innovative technologies with an equally innovative financial model, the Tabbre Project offers a viable pathway to achieving net zero emissions, alleviating global poverty, and establishing a decentralized financial system that rivals traditional fiat-based systems. Through these efforts, Tabbre aims to not only meet the urgent demands of the present but also build a sustainable and equitable future for generations to come.